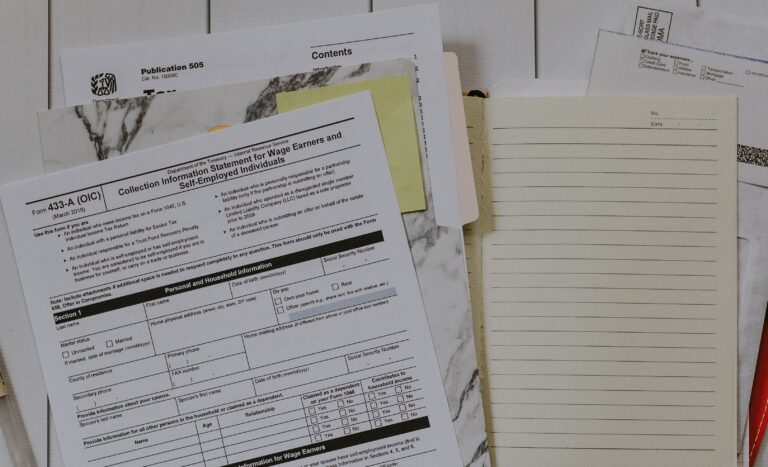

Filing a Business Tax Extension

By Turbo Tax If you need more time to file your business taxes, the IRS allows extensions for most tax returns. However, while you can delay filing, you’ll still need to estimate how much you owe and make a payment. Learn how to file a business tax extension, key deadlines for S-Corps, C-Corps, and partnerships,…