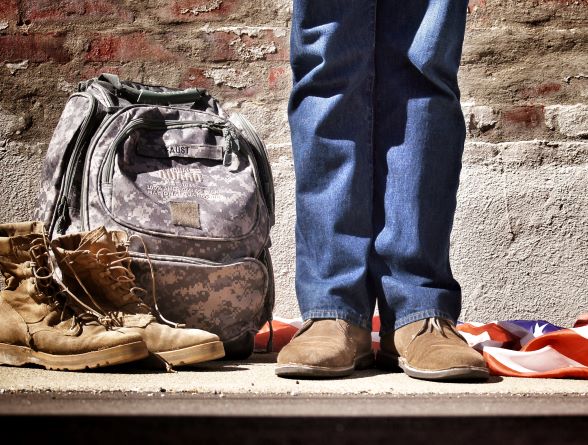

The Work Opportunity Tax Credit helps businesses that hire from eligible groups

Finding work can be a hard for anybody and certain groups face even bigger challenges. The Work Opportunity Tax Credit is extended through the end of 2025 to help employers that hire workers certified as members of these groups that face barriers to employment: People who receive: Long-term family assistance Long-term unemployment Supplemental Nutrition Assistance…