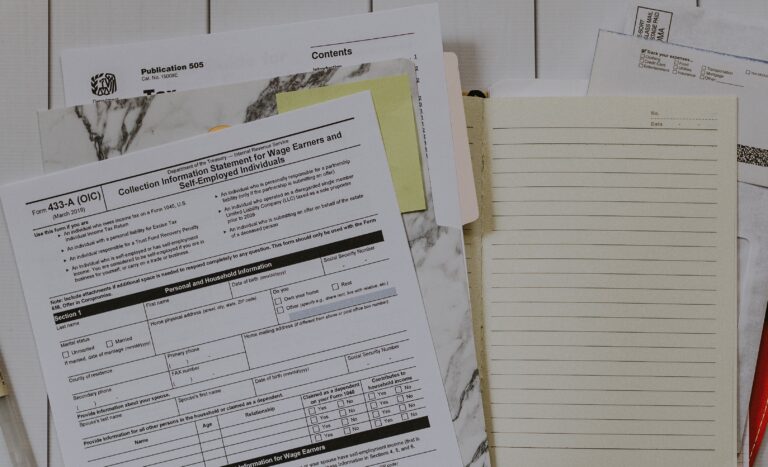

Most taxpayers who requested an extension to file their 2023 tax return must file by Oct. 15

The Oct. 15 extension deadline to file taxes is fast approaching. Most taxpayers who requested an extension of time to file their 2023 tax return must file by Tuesday, Oct. 15, to avoid the penalty for filing late. The IRS urges people to file electronically.Remember that an extension to file was not an extension to…